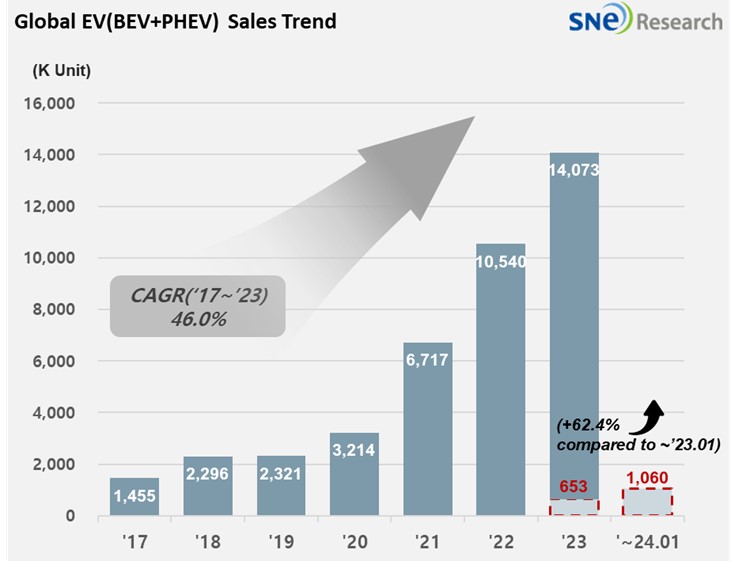

In January 2024, Global[1] Electric Vehicle Deliveries[2] Posted 1.060 Mil Units, a 62.4% YoY Growth

- BYD taking the global No. 1 position in EV sales

In January 2024, the total number of electric vehicles registered in countries around the world was approximately 1.060 million units, a 62.4% YoY increase.

(Source: Global EV and Battery Monthly Tracker – Feb 2024, SNE Research)

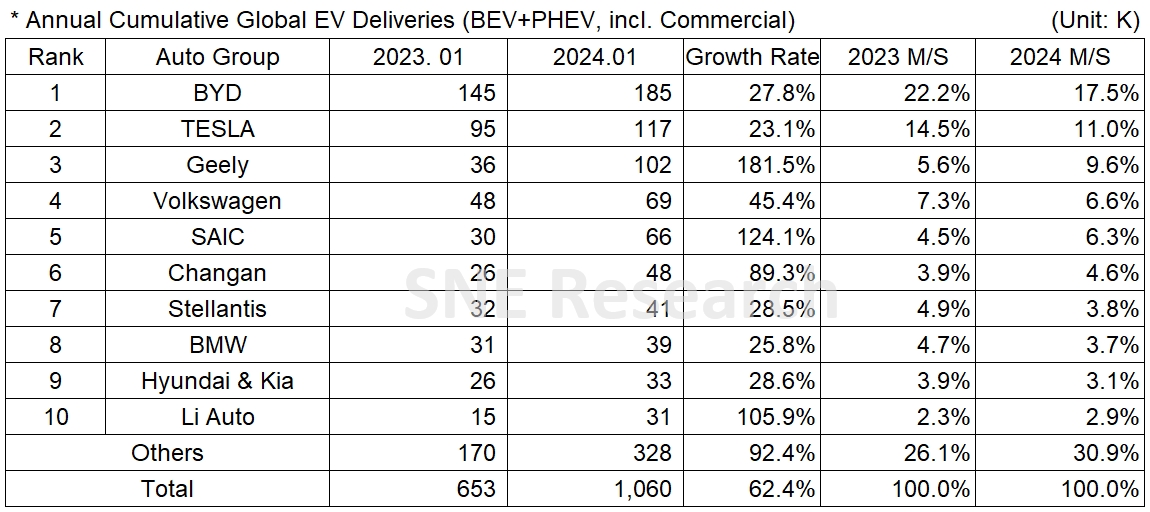

If we look at the global EV sales by major OEMs in Jan 2024, the leading EV maker in China, BYD posted a 27.8% YoY growth, keeping the global top position. BYD continued to be in the upward trend in 2024 thanks to favorable sales of light EVs such as Seagull (海鸥) and Dolphin (海豚). Not only with those light EV models, BYD gradually expanded its market share by providing a broad range of option to drivers by offering various segments such as Song and Yuan plus and establishing sub-brands like Denza(腾势) and Yangwang(仰望). Tesla posted a 23.1% YoY growth driven by the sales of Model Y, but ranked 2nd outrun by BYD who has both line-ups of BEV and PHEV. If their BEV sales are compared only, Tesla sold slightly more (117k units) than BYD (101k units).

The 3rd place was captured by Geely Group. Similar to BYD, Geely’s light EV model, Panda (熊猫) MINI saw more than 10k units sold, looking quite favorable to Geely. The Group, a parent company of Volvo, has launched sub-brands such as Galaxy (银河), ZEEKR (极氪), and LYNK & CO (领克) to target the mid/high-end vehicle market by adding more diversity to its portfolio.

(Source: Global EV and Battery Monthly Tracker – Feb 2024, SNE Research)

Hyundai-KIA Group posted a 28.6% YoY growth. Although the sales of IONIQ 5/6, Niro, and EV 6 were slow, the sales of new Kona Electric (SX2 EV) and EV 9 have expanded in the global market, and the overseas sales of Sportage and Tuscan PHEV also increased. On March 4, Hyundai Motors unveiled ‘2024 Kona Electric,’ ‘IONIQ 6 Black Edition’ and ‘The New IONIQ 5’ of which overall commercial value was heightened with battery performance enhanced and user-friendly features added. The car maker announced that, by offering various options of electric vehicles to customers, it would firmly capture its leading position in the Korean EV market. KIA was reported that it would focus on taking the leadership in the eco-friendly vehicle market by starting the overseas sales of EV9 and selling mid- and small-size EVs – from EV3 to EV5 with price competitiveness. It was known that KIA also wants to increase the profitability through the expansion of car sales.

(Source: Global EV and Battery Monthly Tracker – Feb 2024, SNE Research)

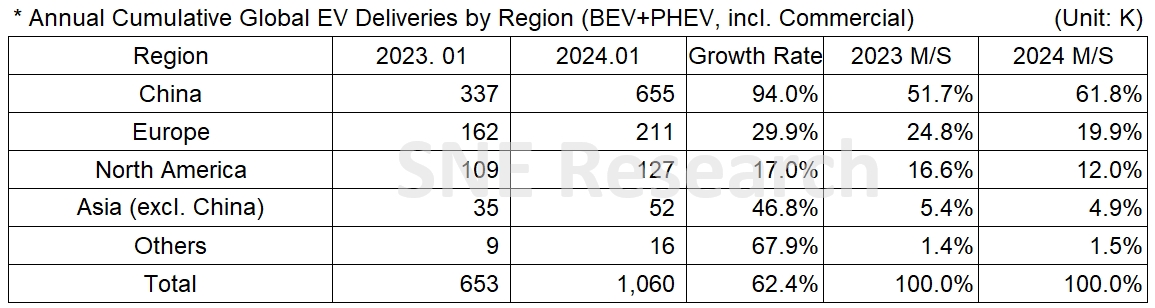

By region, China firmly kept its position as world’s biggest EV market, taking up 61.8% of the entire market share. Unlike January 2023, when the EV sales dropped significantly due to the termination of subsidy, this month saw an increase in the sale of light EVs with price competitiveness. In addition, the launch of sub-brands by major OEMs seems to be effective in broadening the range of options available for consumers. Furthermore, OEMs are also required to manufacture a certain portion of their vehicles as new energy vehicles according to China’s New Energy Vehicle mandate policy. All of these seem to gradually add up to the popularization of electric vehicles.

In Europe, EVs took up 19.9% of the entire market share, showing a growth mainly led by BEV. However, the European People’s Party (EPP), the majority party in the European Parliament offered its opposing views on the 2035 ICE ban proposed by the European Union (EU) by saying that, instead of forcing the transition to electric vehicles, it would want to protect the climate through carbon credit trading, expanding the use of renewable energy, and establishing the circular economy.

In North America, the EV market showed a growth thanks to favorable sales of Tesla and JEEP’s PHEV line-up. With the next Presidential election scheduled in November this year, the Biden administration has been reviewing and revising its plan to reinforce emission regulations in order to control the speed of transition to electric vehicles. Former US President, Donald Trump, harshly criticized the clean-energy policies by the current administration and affirmed that we should focus on the manufacturing of internal combustion vehicles.

As mentioned above, there have been prevailing talks about speed bumps in the road to electric vehicles in major countries such as Europe and the US, leading major OEMs to revise their EV investment plans and electrification strategies. Mercedes-Benz delayed its electrification target by 5 years and assured investors that it would continue to enhance its combustion engine models. Due to the sluggish market, GM abandoned a goal of making 400,000 EVs by early 2024, which was announced just last year. Ford also cut production of its F-150 Lightning pickup truck and Mustang Mach-E.

Amidst such a momentary slowdown in the EV demand growth, it is expected that, in the short term, hybrid vehicles -metaphorically speaking, which may work as a steppingstone for EVs to move from early-adapters to general publics – would draw more attention from the market.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.